Know Where you are Spending your Money

Magnify your Savings

Have you ever thought to yourself “where is all my money is going?”

Well, let’s be honest, you really don’t need a detective to,

- advise you that you are the prime suspect

- have access to records of your spending transactions and

- identify that you are guilty of being very good at spending

Spending is easy and saving can be hard. But having an awareness of how much money is coming in and going out of your bank account is the first step to managing your money.

Gathering the Evidence

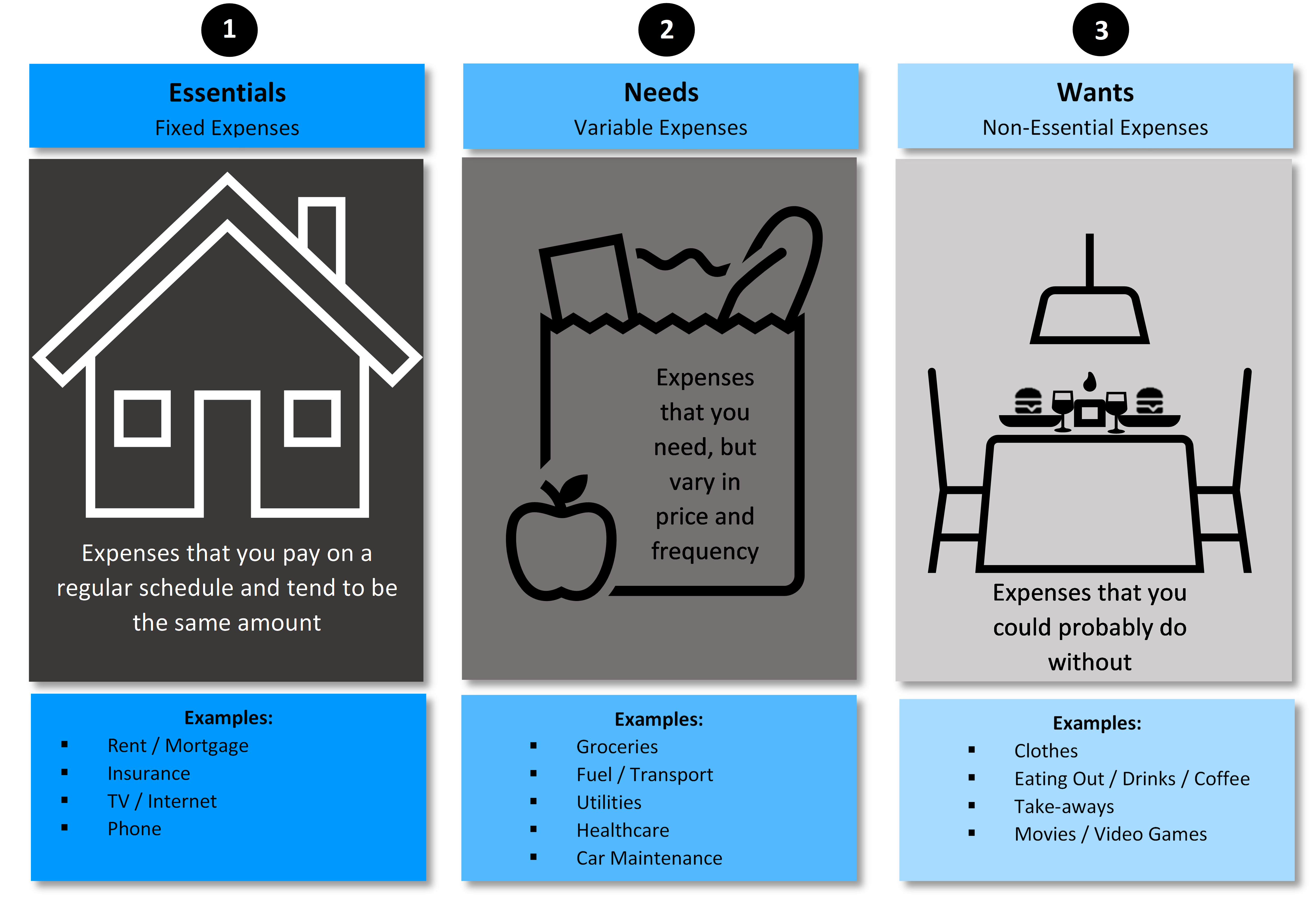

We can split spending into three categories:

The Curious Case of Food and Drinks

Let’s use coffee as an example

You buy a coffee 5 x a week - that’s $4.50 a day, $22.50 a week, $1,170 a year.

Slapping your card on an Eftpos machine for $4.50 may not be a big deal. But lots of small regular payments do add up over time.

Now, let’s say you eat out once a week or grab take-aways, like my favorite, Burger Fuel. A burger and fries are about $20. That’s $80 a month and $1,040 a year.

To put it into perspective, in 1 year, you are spending $2,210 on weekly coffees and take-aways.

It’s not about cutting them out completely, but if you want to start saving for any of your goals, recognizing your spending habits will help you decide where you can make small changes over time.

The Investigation

If you track your expenses for at least one month, you will get insight into where your money is going.

You could do this in an app such as Money which is free and user-friendly: https://monefy.me/

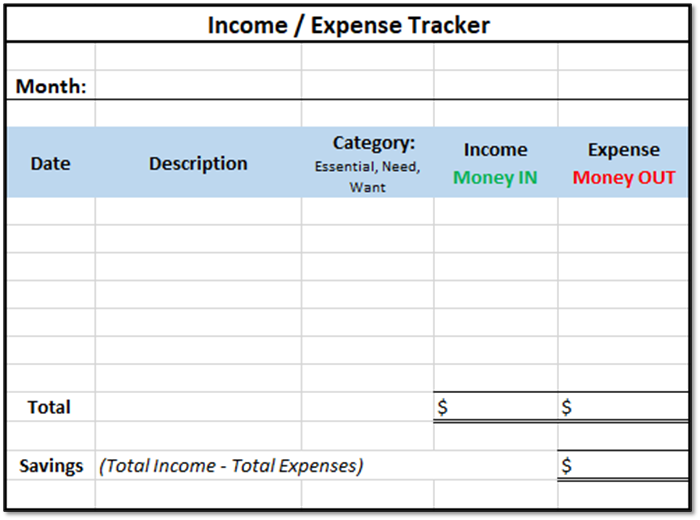

Or you could whip a quick table in Excel like the picture below to track your money coming in and money going out.

By categorizing each transaction as either an essential, need or want expense, you can see where you are spending most of your money and where you have the potential to cut back and save.

The most effective way to make lasting changes is to make small changes over time. So don’t cut out all your fun things - life is meant to be enjoyed! It’s just about having an awareness of your financial situation, so you can achieve your goals.

Just like compound interest – small changes combined with consistency, can lead to big outcomes!

Case Closed.